ATTENTIOn: CANADIAN BUSINESS OWNERS

Access Your Retained Earnings – Without Losing Half to the CRA.

Your corporation may qualify to extract a portion of retained earnings tax-free, without selling your business, restructuring, or triggering a 40–50% personal tax bill.

This is not generic tax planning.

This is a precision-designed strategy available only to qualified business owners.

PROBLEM

Does this sound like you?

You’ve built the business. You’ve saved the capital. But when it’s finally your turn to use that money… the system punishes you.

You lose 40–50% every time you try to take money out personally — even though it’s your own retained earnings.

You feel like you’re overpaying tax, but no one has given you a clear, CRA-aligned alternative.

Your accountant keeps you compliant… but hasn’t shown you how to actually access your money efficiently.

Your retained earnings sit trapped indefinitely — losing value to tax, inflation, and opportunity cost.

You’re Not Doing Anything Wrong —

The System Just Isn’t Built for You.

You’re in the same situation as most business owners we work with.

You built the business.

You saved the capital.

But now that it’s your turn to use that money — for lifestyle, legacy, or new opportunities — the system punishes you.

And at some point — whether it's now or years from now — you WILL have to deal with those retained earnings.

The only question is whether you deal with it when its in YOUR control — or when it becomes far more expensive.

The longer those retained earnings sit untouched, the more you lose to silent erosion:

Taxes

Inflation

Missed investment opportunities

Delayed personal goals

It’s not that leaving funds inside the corporation is “bad.”

It’s that doing nothing costs you more every year — without you realizing it.

Not because you did anything wrong —

but because the system only shows you one path: the expensive one.

UNTIL NOW....

THE SECRET

Not All Income is Taxed The Same

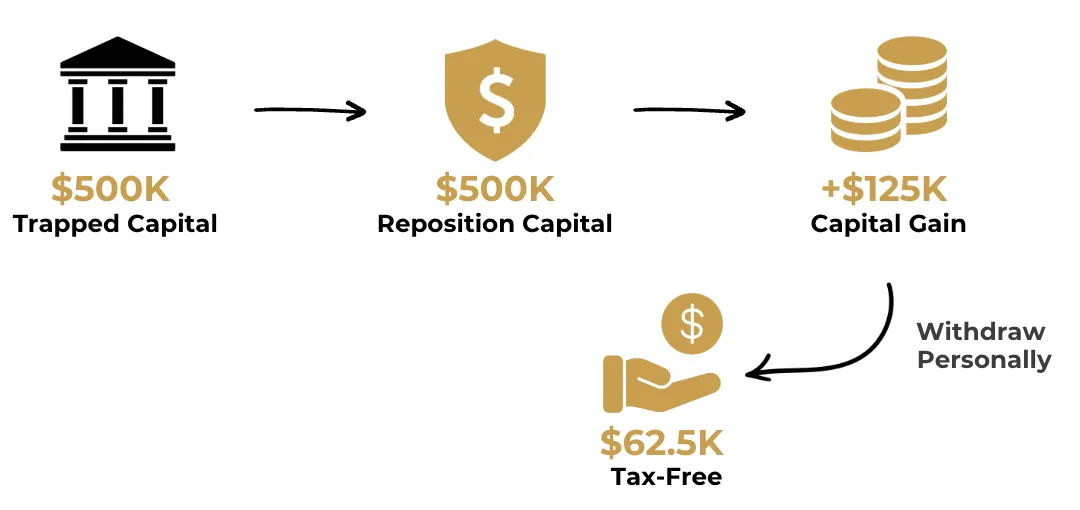

Inside your corporation, every dollar you withdraw falls into one of a few income types. And here’s the part every business owner knows on the surface — but almost no one fully understands:

Salary, dividends, and interest are all taxed at the highest personal rates.

Capital gains are different.

Only half of a capital gain is taxable.

And the other half can be paid directly to you tax-free through your Capital Dividend Account.

This is not a loophole.

Not a secret.

Not a grey area.

It’s simply a part of the Income Tax Act that most owners never use when accessing retained earnings — because nobody taught them how.

Every accountant, advisor, and business owner knows capital gains are favoured.

But here’s what almost no one is ever shown:

How to actually use that difference to take money out tax-free.

The missed opportunity is NOT understanding the difference.

The missed opportunity is not knowing how to actually USE that difference.

That’s where everything changes....

WHAT WE DO

We Help You Access More of Your Money

We use a short-term, fully documented, CRA-aligned structure designed specifically for incorporated business owners who want:

Tax-free personal liquidity

No loss of corporate value

Audit-ready compliance

Independent third-party verification

Full transparency

Zero exposure to aggressive tax schemes

This is not an accounting trick, loophole, or shelter.

It is a private capital strategy used for years by institutions, dealers, and sophisticated family offices — now available to qualified business owners.

You get access to this capital IMMEDIATELY.

What You Get

Keep More of Your Money

Use the income category the CRA favours — not the expensive ones.

Day-One Liquidity

Access capital immediately without disrupting your corporation.

Zero Corporate Changes

Your corporate structure stays exactly the same.

Repeat Annually

Create reliable, tax-efficient liquidity year after year.

Fund What Matters

Lifestyle, investments, retirement, — your money finally works for you.

Stop Silent Erosion

Avoid losing wealth to tax drag and missed opportunities.

Real Success Stories, Real Results

RETIREMENT INCOME

A couple with $1.4M in retained earnings wanted tax-efficient retirement cash flow.

They accessed $175,000 tax-free without touching their salary or dividends.

Now they repeat the process annually to supplement their retirement income.

WEALTH TRANSFER

A parent with $3.2M retained earnings wanted to help their daughter buy her first home.

They accessed $400,000 tax-free, allowing them to support the down payment without losing half to tax.

It became their preferred way of transferring wealth.

SHAREHOLDER LOAN CLEANUP

A founder with $900,000 retained earnings needed to clean up a shareholder loan.

They accessed $112,500 tax-free, reducing the loan efficiently without triggering a large personal tax bill.

Their books became cleaner and future planning simpler.

REDUCING PERSONAL SALARY TAX

A professional with $720,000 retained earnings felt crushed by high salary tax.

They accessed $90,000 tax-free, replacing part of their annual income with a more efficient flow.

Their personal liquidity increased immediately.

FUNDING A NEW INVESTMENT

An entrepreneur with $650,000 retained earnings wanted liquidity for a real estate deal.

They accessed $81,250 tax-free, allowing them to act quickly without pulling taxable dividends.

They kept their corporation untouched while expanding personally.

CLEAN BUSINESS EXIT

A business owner with $8M in retained earnings wanted to begin moving capital out of the company efficiently.

They accessed $1,000,000 tax-free, giving them substantial liquidity for long-term wealth planning.

It now forms a core part of their annual wealth-preservation strategy.

HOW IT WORKS

The AMA Process

1. Private Eligibility Assessment

We discreetly review your corporation, to confirm if you qualify. Only approved clients advance.

2. Personalized Blueprint

If eligible, we design a confidential, CRA-aligned pathway for efficient personal access — tailored to your corporation.

3. Immediate Liquidity

Upon execution, you receive efficient day-one personal access, with the option to repeat annually for predictable, long-term liquidity.

This Isn’t a One-Time Fix — It’s a Repeatable Wealth Strategy.

Most owners use our program annually because the benefits are not limited to a single cycle.

This can be repeated every 12-18 months.

Each time you complete the cycle:

Your get immediate personal liquidity

Your tax efficiency improves

Your capital works harder for you

Your corporation continues growing normally

Your long-term wealth compounds faster

This isn’t a one-off solution.

For many clients, this becomes a permanent part of their financial strategy — because once you experience efficient access, there’s no reason to go back to traditional withdrawal methods.

Why You Must Act Quickly

This is NOT a general “tax strategy.”

This strategy requires specific, independently verified assets.

Once those assets are allocated to clients,

the opportunity closes until new spots become available.

This is not a rolling, unlimited offer.

STOP LETTING THE SYSTEM ERODE YOUR CAPITAL

Book Your Private Eligibility Call

15 minutes. No obligation. No pressure.

During the call, we will:

Review your retained earnings

Evaluate your corporation's eligibility

Show your potential tax-free extraction amount

Provide next-step timelines

If qualified — reserve your spot

Your retained earnings should work for you, not against you.

If you qualify, we’ll show you exactly how to unlock efficient personal access — safely, privately, and CRA-aligned.